This year has been very tough for me and my family. We unexpectedly lost my mom to a brain aneurysm out of the blue. One minute she was here and the next she was gone. It was that quick. I learned to take nothing for granted and I’ve made sure we are covered as much as possible should the unexpected happen because in the blink of an eye it can all change.

Every October we’ve had to re-enroll our family’s health insurance through my husband’s employer. For most U.S. companies, fall marks open enrollment season, a time when workers can review their employer-sponsored benefits offerings and choose the health insurance policies that best meet their financial and health care needs.

What is Open Enrollment? Why should it matter to me?

Although selecting the right health care benefits may be one of the most important decisions Americans will make all year, an Aflac survey found that many workers do very little research to learn which plans and products really work best for them. I’m very fortunate to have a sister who works in hospital billing and has a lot of knowledge about insurance. We researched together and compared plans and I felt very comfortable choosing our coverage. But did you know that only 34 percent of employees spend 15 minutes or less researching their benefit options in 2014?1

Those who don’t set aside time to research their insurance options often end up with inadequate health care protection for themselves and their families.

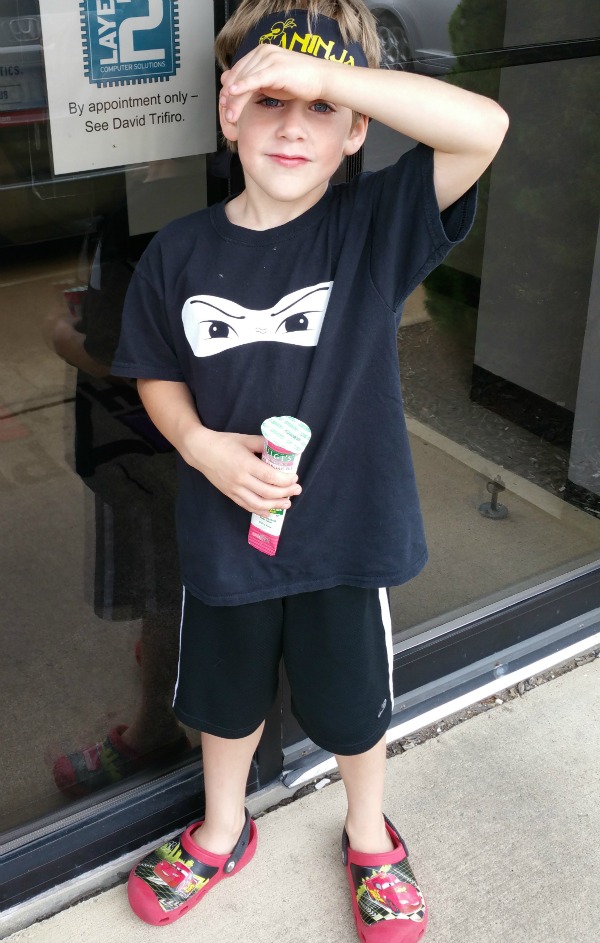

This is one of three reasons understanding and choosing the right insurance is important for my family. He participates in Parkour and Baseball and anything can happen!

Did you know different generations have different health care needs that reflect their life stages?

Today’s workforce is comprised of a number of different generations, including baby boomers, Generation X, millennials/Generation Y and the incoming generation of workers known as Generation Z. Our insurance needs are very different from our parents and even from my siblings who are a few years older than me. For instance, the type of benefits options a young, single employee needs are significantly different than those for an employee who is supporting multiple dependents or facing more health issues due to advanced age. That’s where voluntary insurance helps, since it allows employees to select voluntary policies that best suit their own needs, as well as the needs of any dependents they may have.

Have you considered voluntary insurance policies offered by your employer?

When an unforeseen medical event occurs, many people are often faced with paying copayments, deductibles or treatment costs not covered by major medical insurance, as well as other daily living expenses – all while paying increasing health insurance premiums. Voluntary policies, which complement major medical coverage, are specifically designed to help pay for out-of-pocket expenses that can be associated with an unexpected illness or injury.

Research your benefits this Open Enrollment season and find the right voluntary policies to help keep every generation of your family protected. Below are a few different types of voluntary insurances your employer may offer.

Critical Illness Insurance

Critical illness protection helps you stay ahead of the medical and out-of-pocket expenses that result from certain medical issues, such as a stroke or heart attack. Critical illness insurance helps cover expenses from initial diagnosis through treatment for covered health events.

Accident Insurance

Accident insurance helps provide everyday financial protection in the event of a covered accident. Benefits are paid for things like x-rays, physical therapy, appliances, emergency treatment and more.

Cancer Insurance

In the U.S., the lifetime risk of developing cancer is slightly less than a 1 in 2 risk for men and a little more than 1 in 3 for women. In addition, more than 1.6 million new cancer cases are expected to be diagnosed in 2015 alone.5

Having a cancer insurance policy in place can help protect you from the sometimes overwhelming costs associated with being diagnosed with cancer. These types of voluntary policies can be used not only for treatment expenses not covered by major medical insurance, but also for extra child care that may be needed, transportation to and from the doctor or treatments, and even everyday living expenses, such as mortgage payments or groceries.

Hospital Indemnity Insurance

Even if you have major medical insurance, it likely won’t be enough to cover every expense associated with a hospital stay, such as rising deductibles, copayments and out-of-pocket maximums. Hospital insurance pays cash for covered hospital stays, with optional benefits for diagnostic procedures, surgery, ambulance transport and more.

Life Insurance

We were very fortunate that my mom had a small life insurance policy. It was nice knowing that we wouldn’t have to stress coming up with money for her funeral expenses.

For those who are young and single, life insurance can be used to cover funeral/burial expenses, pay off creditor debt or provide parents with funds for retirement. If you are a mom or dad, benefits can help cover your child’s college education, or help your spouse continue to pay the mortgage or any other financial need following the loss of a loved one.

Disability Insurance

Short-Term Disability insurance pays a percentage of your income if you are unable to work due to a covered illness or injury. Benefits are paid directly to you, unless otherwise assigned, to help cover things like deductibles, car payments, utility bills and more.

1. 2015 Aflac WorkForces Report conducted in February 2015 by Research Now on behalf of Aflac, accessed Sept. 2, 2015 – http://workforces.aflac.com/

5. American Cancer Society, “Cancer Facts & Figures 2015,” accessed Sept. 16, 2015 – http://www.cancer.org/acs/groups/content/@editorial/documents/document/acspc-044552.pdf

The other two reasons having the right insurance for our family is important. They love keeping up with their older brother!

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

Leave a Reply